Why Truck Stops Fit Getty's Portfolio Better Than People Think

How data-driven TA development matches Getty's essential retail DNA

Getty may perceive truck stops as niche or outside their core. In reality, data-validated truck stops exhibit the same essential-use profile as C-store/QSR gasoline properties—but with superior fundamentals.

Getty's Traditional Fueling Assets

- C-store + gasoline (passenger vehicles)

- Discretionary convenience purchases

- Competition from nearby gas stations

- Sensitive to local traffic patterns

- Subject to consumer preference shifts

- Moderate switching costs

Milepost's Data-Validated Truck Stops

- TA/LVP + diesel (commercial fleets)

- Nondiscretionary fuel + HOS-mandated parking

- Limited competition (supply-constrained market)

- Predictable corridor-level demand

- Mission-critical for operator economics

- High switching costs (fleet routing, loyalty programs)

The Essential Retail Parallel

Getty values C-stores and QSR fueling sites because they serve needs-based, predictable demand with sticky customer bases. Truck stops amplify all of these characteristics:

- Higher throughput: 600K–1.8M gallons/month diesel for our sites

- Superior margins: Diesel margins typically 3x gasoline margins

- 24/7 demand: Federal HOS rules create round-the-clock traffic (no off-peak)

- Lower elasticity: Freight activity continues regardless of consumer sentiment

- Stickier customers: Fleet routing and loyalty programs lock in repeat visits

Superior Real Estate Fundamentals

Oversized Parcels

Typical TA site: 10–20 acres vs. 2–5 acres for C-store/gas. Provides:

- Multiple pad-out opportunities (QSR, hotel, logistics)

- EV charging scalability without land constraints

- Parking monetization (overnight truck parking = revenue)

- Greater flexibility for fallback uses

Corner Access at Key Interchanges

Milepost targets high-visibility interchange corners, ensuring:

- Dual ingress/egress configurations

- Strong roadway exposure (billboard-equivalent visibility)

- Getty's "strong corner" criterion automatically satisfied

- Comparable to Getty's best C-store/QSR locations

Multiple Reuse Paths

If TA/LVP exits, sites support diverse alternative uses:

- C-store + gasoline conversion (instant Getty familiarity)

- QSR pad-outs (McDonald's, Subway, Wendy's)

- EV charging hubs (future-proofed infrastructure)

- Last-mile logistics/fleet fueling (Amazon, FedEx, UPS)

Industrial + Essential Retail Hybrid

Getty's portfolio increasingly touches last-mile distribution, fleet fueling, and EV infrastructure. Truck stops sit at the intersection of these trends.

- Industrial adjacencies: Truck stops serve freight/logistics—Getty's growing focus area

- Fleet fueling backbone: TA/LVP sites are critical infrastructure for Amazon, Walmart, FedEx fleets

- EV transition-ready: Large parcels + electrical capacity = future charging hubs

- Hydrogen optionality: Truck stops are first candidates for H2 refueling networks

NNN-Friendly Operating Structure

Getty prefers long-term NNN leases with predictable credit profiles. TA/LVP truck-stop leases deliver exactly that.

Getty's Preferred Lease Profile

- 15–25 year initial terms

- NNN structure (tenant pays taxes, insurance, maintenance)

- Investment-grade or near-investment-grade credit

- Mission-critical locations for operator

- Built-in rent escalations

Typical TA/LVP Truck-Stop Lease

- 20–30 year initial terms ✓

- Absolute NNN structure ✓

- TA (BP subsidiary) / LVP (strong private credit) ✓

- Operator's most profitable site category ✓

- CPI-indexed or fixed escalations ✓

How Milepost Closes the Information Gap

Traditional underwriting lacks granular demand insight for truck stops. Our cohort/gallons framework eliminates that ambiguity and brings the segment into Getty's comfort zone of "predictable, stable operations."

Traditional Underwriting Limitations

- HPMS counts all vehicles (not diesel buyers)

- Traffic studies provide corridor averages, not site-specific demand

- No visibility into parking saturation or overnight dwell

- Competition analysis relies on radius counts (ignores overflow dynamics)

- Getty IC must trust developer intuition vs. verifiable data

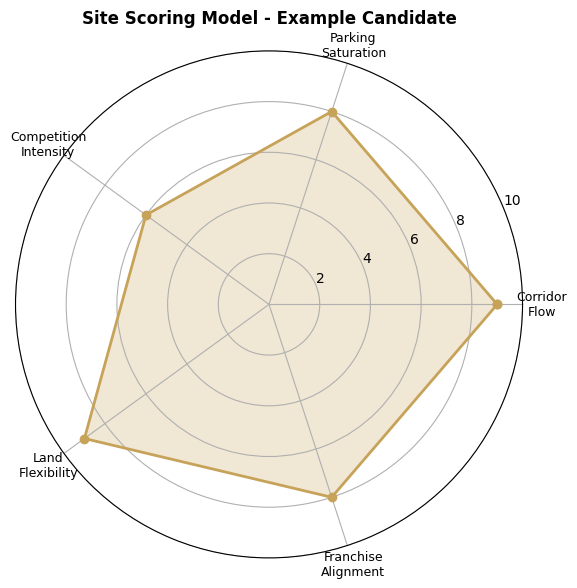

Milepost's Data Advantage

- 180,000-device trucker cohort isolates diesel buyers

- Site-specific gallons proxy validated against LVP sales

- Parking saturation curves quantify unmet demand

- Cluster vs. frontier framework reveals opportunity type

- Getty IC receives transparent, auditable validation

The Misconception Radar

Addressing common investor concerns about truck stops—and why data changes the conversation.

"Truck stops are too niche for our portfolio."

DATA-GROUNDED REBUTTAL:

Truck stops serve 3.5M commercial drivers nationwide—larger addressable market than many Getty C-store/QSR segments. Milepost's cohort identifies sites on major corridors with higher throughput than typical gas stations. This is scaled essential retail, not niche.

"Diesel demand will collapse with EV transition."

DATA-GROUNDED REBUTTAL:

Class 8 trucks (18-wheelers) represent 20+ year transition timeline due to payload, range, and charging infrastructure constraints. Milepost sites are selected for EV charging scalability (large parcels + electrical capacity). Getty acquires transition-ready infrastructure, not stranded assets.

"Truck-stop underwriting is too uncertain."

DATA-GROUNDED REBUTTAL:

Traditional underwriting lacks precision—Milepost eliminates that gap. Our cohort-to-gallons model provides site-specific revenue proxies validated against actual LVP sales. Getty IC receives more certainty for truck stops than for typical C-store acquisitions with generic traffic studies.

"Limited alternative use if operator fails."

DATA-GROUNDED REBUTTAL:

Milepost selects oversized parcels (10–20 acres) at high-visibility interchanges. Alternative uses include C-store/QSR conversion, last-mile logistics, fleet fueling, EV charging hubs, and truck parking monetization. Real estate fundamentals match or exceed Getty's traditional fueling assets.

The Bottom Line

If Getty's core is essential retail with great real estate and predictable cash flows, then Milepost truck-stop sites are simply the next evolution—

Same DNA. Bigger Opportunity.

- 24/7 nondiscretionary demand > discretionary C-store traffic

- 100–150K gallons/month > 50–80K for passenger sites

- Oversized parcels with multiple fallback uses > constrained 2–5 acre pads

- Mission-critical for fleet operators > convenience preference

- Data-validated revenue projections > generic traffic studies

- 20–30 year NNN leases > Getty's standard lease profile

Milepost's quantitative validation brings truck stops into Getty's investment-grade comfort zone.

Ready to Explore the Data?

See how Milepost's programmatic approach delivers Getty-ready truck-stop opportunities with unprecedented transparency.

Our Process