Our 4-Step Pipeline

From national-scale geofencing to Getty-ready site packages

STEP 1

National-Scale Geofencing

We built the most precise truck-stop geofence database in the industry through 500+ hours of manual labeling.

- 1,800 major truck-stop polygons covering TA, Love's, Pilot Flying J, and other national chains

- 1,000 strong non-major facilities including regional chains and high-performing independents

- 1,800 parking sub-polygons with manual overnight dwell classification

- Hourly presence heatmaps revealing peak demand windows and capacity constraints

Why This Matters: Algorithmic geofences miss parking lots, misclassify diesel bays, and blur facility boundaries. Our manual precision enables accurate cohort-to-gallons mapping that Getty's IC can trust.

STEP 2

Trucker Cohort Mobility Dataset

We filter 180,000 devices exhibiting trucker behavior patterns—the most accurate fuel-demand proxy available.

- 180,000 active devices continuously tracked across U.S. highway corridors

- 10-meter accuracy enabling precise facility attribution

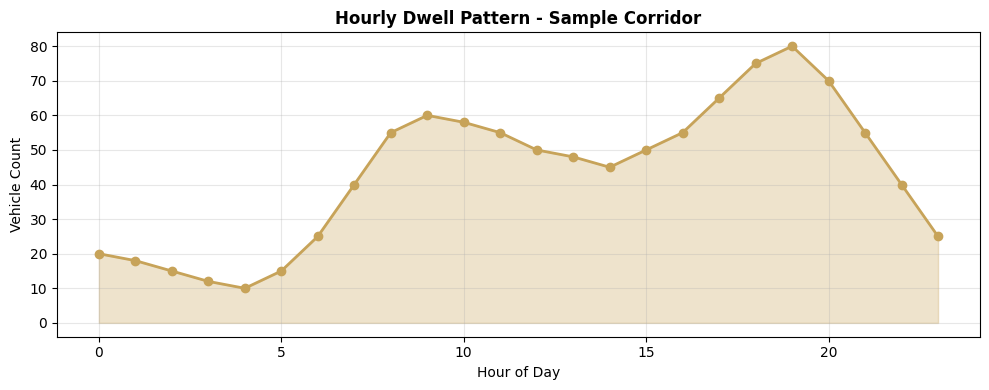

- 15-minute ping resolution revealing hourly demand curves and overnight dwell patterns

- Behavioral filtering isolates true trucker patterns from passenger car noise

- Hour-of-day presence heatmaps showing when lots fill and when demand peaks

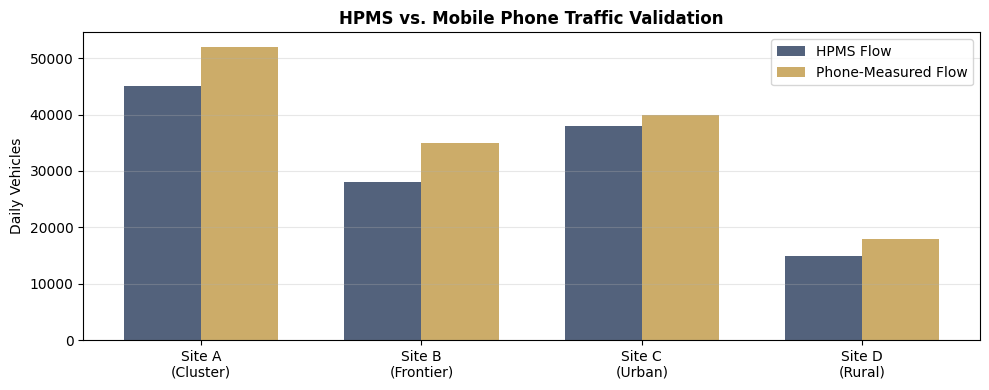

Getty Advantage: HPMS provides both all-vehicle and Class 8 truck counts; our cohort isolates actual diesel-buying behavior patterns. This removes the guesswork from fuel demand forecasting.

STEP 3

Gallons Estimation Engine

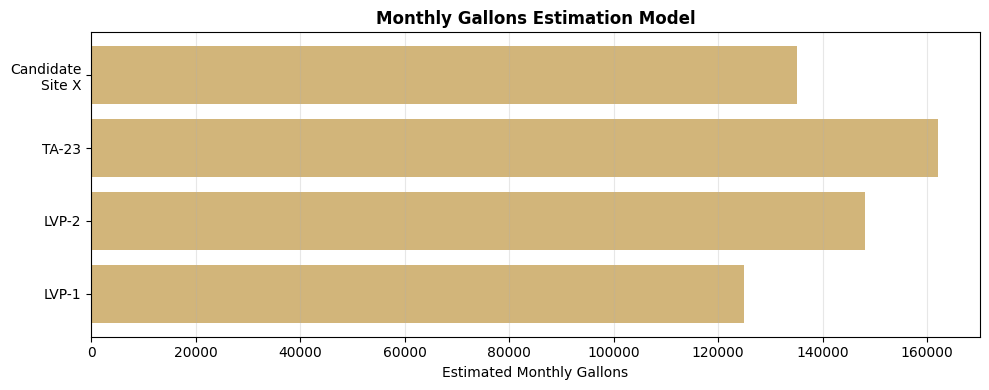

We reverse-engineer actual fuel sales from known LVP sites, then generalize that model to all 1,800 major facilities and every candidate parcel.

- Known gallons baseline from LVP partnership sites with verified sales data

- Visit-to-gallons mapping correlating cohort visit frequency to actual monthly fuel volume

- Model generalization across all TA, Love's, Pilot facilities nationwide

- Candidate scoring assigns each prospective site its own gallons proxy

- Confidence intervals quantify forecast precision for Getty underwriting

Getty Confidence: This is not a traffic study proxy—it's real fuel demand measured from actual trucker behavior, validated against known sales.

STEP 4

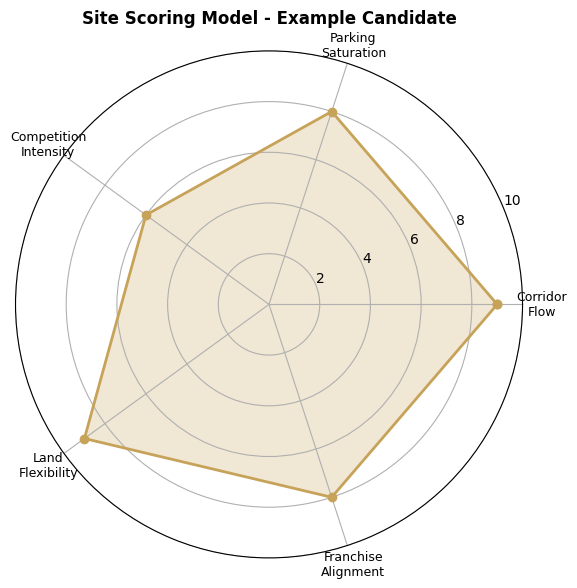

Comprehensive Scoring Model

Every candidate site receives a multi-dimensional risk score covering demand, competition, saturation, and real estate fundamentals.

- Corridor flow scoring using both HPMS and phone-measured traffic

- Parking saturation probability from overnight dwell fill curves

- Competitive intensity analysis within 5-mile radius (cluster vs. frontier designation)

- Land flexibility assessment for fallback alternative uses (QSR, C-store, EV, logistics)

- Franchise alignment scoring for TA/LVP operational fit

Getty IC Receives: Transparent, auditable scoring with no black-box algorithms. Every metric ties back to verifiable data sources.

What Getty's Investment Committee Receives

Data Package

- Parcel geometry and ingress/egress analysis

- HPMS vs. phone-measured flow comparison

- Cohort-based gallons proxy with confidence intervals

- Competition cluster map (5-mile radius)

- Parking saturation curves and overnight dwell metrics

Risk Assessment

- Fallback alternative-use scoring

- Real estate fundamentals independent of operator

- Demographic and employment trends

- Environmental and zoning pre-clearance

- Comparable sales analysis

Getty-Ready Deliverables

- Executive site brief (3-5 pages)

- Visual demand validation dashboards

- NDA-protected methodology appendix

- Franchise alignment assessment

- Data room access for deep-dive due diligence