Programmatic TA Development—Driven by Real Data, Built for Getty.

We are not traditional developers asking brokers for parcels. We invert the process—we surface parcels where data proves success.

Our Competitive Advantage

Data-Validated Sites

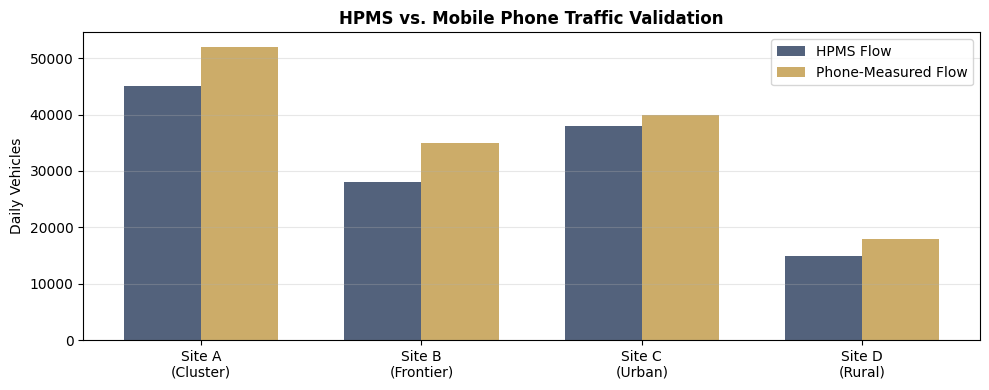

Every candidate parcel is quantitatively validated using 180,000-device mobility cohorts, HPMS flow verification, and manual geofence precision. Getty receives pre-validated deal flow with uncertainty removed.

Cohort-Measured Fuel Demand

We map trucker visit patterns to actual gallons sold at LVP sites, then generalize that model across 1,800 major truck stops nationwide. Each candidate receives its own gallons proxy—no guesswork.

Cluster + Frontier Strategy Engine

Our data identifies both cluster opportunities (high-flow, overflow demand) and frontier plays (supply deserts with hidden traffic). We let the corridor data choose the winning strategy—not intuition.

Our Moat: 500+ Hours of Human-Labeled Geofences

Most mobility data vendors rely on algorithmic geofences that miss critical nuances. We manually labeled:

- 1,800 major truck-stop polygons (TA, LVP, Pilot Flying J)

- 1,000 strong non-major facilities (regional chains, independents)

- 1,800 parking sub-polygons with overnight dwell detection

- 10-meter accuracy

- 15-minute ping resolution for hourly demand curves

This precision enables cohort-based gallons estimation and parking saturation modeling that competitors cannot replicate.

What Getty Receives

A pipeline with uncertainty removed—backed by transparent, data-rich validation.

Parcel-Level Intelligence

- Precise parcel geometry and ingress/egress configurations

- HPMS corridor flow vs. phone-measured trucker flow

- Cohort-based gallons proxy (mapped from LVP baseline sites)

- Competition cluster scoring within 5-mile radius

- Parking saturation metrics from overnight dwell curves

- Fallback alternative-use risk scoring

Getty-Ready Deliverables

- Executive site briefs with visual demand validation

- NDA-protected methodology details

- Transparent scoring model (no black-box algorithms)

- Franchise alignment analysis (TA/LVP fit assessment)

- Real estate fundamentals independent of operator

- Data room access for IC-level due diligence